NEW YORK, June 30, 2020 -- A new industry analysis finds evidence that a longstanding price benchmark, Average Wholesale Price (AWP), does not provide an accurate representation of retail generic drug prices. AWP is used by traditional pharmacy benefit managers (PBMs) to set reimbursement rates for pharmacies on behalf of U.S. health insurers and plan sponsors. The analysis concludes that, while the actual acquisition price of generic drugs purchased by retail pharmacies has decreased over the past six years, the index by which discounts for these drugs are established has increased.

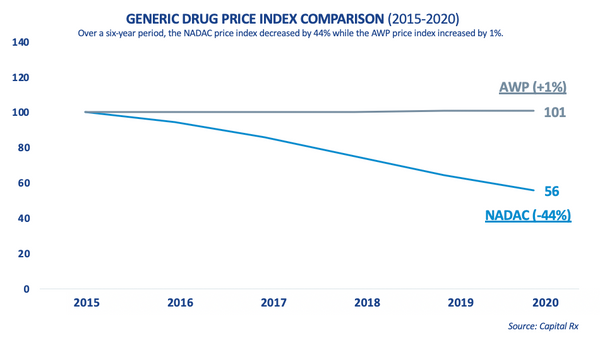

Capital Rx evaluated AWP and National Average Drug Acquisition Cost (NADAC) price fluctuations from 2015 to 2020 for the top 1,200 generic drugs represented in the company’s 2019 book of business. Over this six-year period, the study found evidence of price divergence. The NADAC price index deflated by 44%, while the AWP price index inflated by 1%. Capital Rx conducted the research and collaborated with 3 Axis Advisors (3AA) to externally validate this disconnect. 3AA conducted its analysis using multiple, different methodologies, and in all, found a similar, significant disconnect in the AWP and NADAC price history for generic drugs. Eric Pachman, President and Senior Advisor at 3AA, confirmed, “Regardless of the methods utilized, all analyses demonstrate that for generic medications, AWP-based costs increase over time, whereas NADAC-based costs decline.”

“The industry believes it’s using the best pricing benchmark, but how would anyone know unless you compared it to something else?” said Matt Gibbs, President of Commercial Markets at Capital Rx.

AWP and NADAC are two benchmarks that can be used to price the ingredient cost portion of a prescription drug expenditure. AWP represents a published price for a drug product based on data obtained from manufacturers, distributers and other suppliers, while NADAC reflects actual purchasing trends occurring monthly across participating U.S. retail pharmacies. Although AWP does not represent the average of wholesale prices from actual transactions in the marketplace, most PBMs guarantee a minimum cost discount off this index, while newer market entrants like Capital Rx have begun to offer a NADAC-based reimbursement methodology.

“The data presents strong findings that AWP – the standard traditional PBMs use to determine reimbursements for generic drugs – has increased, while NADAC prices have deflated, significantly. Consequently, the prescription drug prices charged to plan sponsors and their members are based off an inflated AWP starting point, often without their knowledge,” said Joe Alexander, COO of Capital Rx. “We think the question must be asked: if NADAC provides a more accurate and stable representation of ‘real world’ pricing for prescriptions, what has kept the industry from more widespread adoption? Thankfully, since Capital Rx introduced our Clearinghouse Model, we’ve been encouraged by the number of plan sponsors, brokers, and consultants alike that recognize the importance of NADAC-based approaches to help reduce prescription costs.”

About Capital Rx

Capital Rx is redefining the way prescriptions are priced and administered in the U.S. Through its Clearinghouse ModelSM, Capital Rx unlocks the pharmacy supply chain and reduces prescription costs for employer groups. By establishing a competitive marketplace for drug pricing, Capital Rx focuses its resources on deploying actionable strategies that improve plan performance and patient outcomes. The company's commitment to innovation, technology, and service is why Capital Rx is the fastest-growing pharmacy benefit manager in America. For more information, please visit http://www.cap-rx.com.

About the Clearinghouse ModelSM

Capital Rx's Clearinghouse Model is an industry first pricing model that connects buyers and sellers and rebuilds trust across the supply chain. At the center of Capital Rx’s Clearinghouse Model is a cloud-native technology platform that provides plan sponsors with full visibility to the unit price for all drugs in real time. Through this new pricing framework, Capital Rx eliminates arbitrary price variability for patients and employers.

About 3 Axis Advisors

3 Axis Advisors is a highly specialized consultancy that partners with private and government sector organizations to solve complex, systemic problems and propel industry reform through data-driven advocacy. With a primary focus on analyzing U.S. drug supply chain inefficiencies and cost drivers, 3 Axis Advisors offers expertise in project design, data aggregation and analysis. 3 Axis Advisors arms clients with independent data analysis needed to spur change and innovation within their respective industries. The firm’s principles also manage 46brooklyn Research, a non-profit organization dedicated to improving the transparency and accessibility of drug pricing data for the American public. To learn more about 3 Axis Advisors, visit www.3axisadvisors.com